EquityBD Draft Position Paper: Bangladesh National Budget 2024-25, Dt: 29-June 2024

Donors’ Conditions in Lending are Harsh

Prevent Corruption and Money Laundering, Don’t Increase Taxes

A. Debt-dependent National Budget 2024-2025

The Bangladesh government announced a budget of about $68 billion (BDT7,970 billion) for the next fiscal year 2024-25 which is 12% higher than the current year. The revenue collection target for the new year is about $46 billion (BDT5,410 billion) which is 13% higher than the current fiscal year and 68% of the proposed budget. The budget deficit for the new year is about $22 billion (BDT2,560 billion) which is 4.6% of total GDP ($430bn or BDT 50,480bn).

To meet this deficit, the government has to rely on internal and external borrowing and other domestic sources. To cover the deficit, $13 billion (BDT1560 billion) will come from the domestic sector (like domestic bank loans, sale of savings certificates, and different bonds, etc.) and the remaining $8.50 billion (BDT1,000 billion) will be taken as foreign loans. According to the Ministry of Finance, end of December 2023 total country’s debt is about $141 billion (BDT 16,593 billion) which is 33% of GDP and 02 times more than proposed budget. Out of this, the domestic debt is $81 billion (BDT9,538.14 billion) and foreign debt is $60 billion (BDT 7,055.20 billion). Foreign debt is 88% of new year budget.

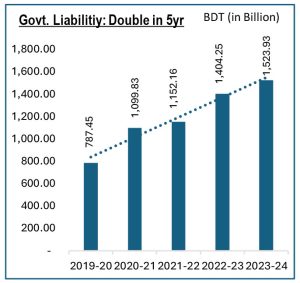

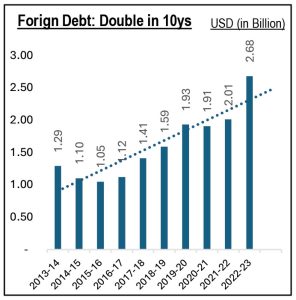

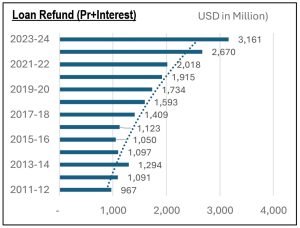

As a result, per capita debt of the country stood at $10 billion (BDT1,180 billion) which is 12% ($108.7 or BDT 12,775) more than last year. In the new fiscal year, the government has to pay loan interest amounting to around $9.60 billion (BDT1,135 billion) from which 03 Padma Multipurpose Bridges can be built. Statistics show that domestic debt has doubled in 05 years and foreign debt repayment has increased by 108% in the last decade. In the current FY 2023-24, 3 billion dollars has to be paid as foreign debt repayment including principal interest and in the new year it is supposed to be 5 billion dollars which is 67% higher. [Daily Protho Alo, 04-June 2024]

Every year we see, the government never achieves the target that is set for revenue collection and later on the target is reviewed and narrowed down. On the other hand, operating expenses are increasing every year. The government should review the operating expenditure and curb the unnecessary expenditure to tackle the fiscal deficit to some extent. Because government is currently facing some tough challenges, like: (1) Extreme inflation, (2) Drastic fall of foreign reserves which is currently around $19 billion (during COVID-19 i.e. end of December 2020 it was $42.97 billion), (3) Declining of foreign investment (which was little over $3 billion in last year and $3.5 billion in 2022. Source: Bangladesh Bank, 28/05/2024), (4) Failure to achieve revenue collection targets, (5) Started repayment of foreign debt of mega projects, (6) Increased money laundering and corruption, (7) Disruption of financial sector, (8) Increase in debt dependency, (9) Pressure on dollar rate increase, (10) Withholding of 5 billion dollars by foreign companies, etc.

B. External debt conditions are increasing poverty

- Intervention by International Monetary Fund (IMF):

In the new year budget, the government has announced the new fiscal policy where IMF’s advice has given importance. Because IMF has agreed to lend $4.5 billion to the government under 30 conditions, where some crucial conditions are (1) Reducing subsidies and increasing prices of electricity, hydroelectricity, oil and gas, (2) Increasing rate and scope of taxes, especially VAT as indirect tax (3) Increase personal tax from 25% to 30%, (4) Reduce corporate tax 22% to 20%, (5) Reduce import duty, (6) Lifting bank interest ceiling (as a result, banks are giving loans at double digit interest rates which was earlier one digit), etc. Mater of fact that government is walking on that path.

As a result, import costs are increasing, credit flows to small and medium industries are decreasing, and inflation is increasing. The living cost of middle-class, lower middle-class, and poor are increasing and becoming unbearable due to placing tax burden on them and reducing subsidies on essential services. This is unfortunate that IMF is not saying anything about curbing money laundering, reducing corruption and cutting unnecessary government expenditure.

- Subsidy money going where?

The subsidy is spending for the welfare of the corporate and special business classes instead of general and poor people. Around $9.2 billion (BDT1,082.40 billion) has been allocated for subsidy in the new year budget. But the question is where will this subsidy be spent? As per IMF advice, the government is considering raising electricity prices 04 times a year, so that the entire cost of the production is recovered from the consumer. 37% of this subsidy or around $3.2 billion (BDT 400 billion) has been allocated to the power sector, of which about 81% will go as capacity charges for private power plants.

In last fiscal FY2022-23, government had paid about $2.6 billion (BDT 280 billion) as capacity charge to the private sector for electricity production. In FY2017-18, this capacity charge was about $518.5 million (BDT 56 billion) and has been increased 5 times or 400% in 5 years. On the other hand, in the last 14 years, the government has paid $7.60 billion (BDT 900 billion) in the name of capacity charge payment. We Think, this privilege is given to a special class of business and for them there has a special Indemnity Act as well.

As per contract, whether power is produced or not, the government must pay this capacity charge to the private power plants. At present, out of total production (about 27,000 megawatt), 40% to 48% of the power generation remains unused. So why this overproduction? Why should the government spend money on this? Why should the government pay the charge to those private power plants, who are inactive i.e. lying idle or have no capacity of power generation? It is unfortunate that these charges are being paid from people’s hard-earned tax money. [Prothom Alo: 05-May 2024; Daily Star-Bangla: 09-June 2024].

So, the government must be strategic in respect of tax collection and its fairness as well as ensured tax justice in respect of wealth collection and its redistribution. That is, more taxes should be collected from the rich and spent for the welfare of poor people. Especially needs to increase budget for food, health, education, water, electricity, gas, sanitation, etc. and reducing its cost for the improvement of the general and poor people.

C. Underground economy and Money laundering: Major hurdles to revenue growth

- Political economy of whitening black money:

One of the major challenges of revenue collection in Bangladesh is undisclosed money or black money. Government is not taking any effective initiative to tackle this undisclosed economy rather allowing all corrupted individuals and businessmen whitening their black money by paying 15% tax like previous years. This will further encourage corruption in all sectors which in turn will facilitate earning more black money. This will discourage the honest taxpayers. This is discriminatory and unconstitutional for the honest taxpayers who will pay maximum 30% tax whereas the black money holders will pay 15% tax for whitening their illegal money. We think that the government is providing this facility for the benefit of some corrupted businessmen so that they could show their illegally earned assets to the bank for borrowing loan and later on laundered it to abroad without paying them and creating more illegal assets.

According to Bangladesh Bank and various economists, the country’s informal economy is 48% to 84% of total GDP. Considering its average rate of 50%, the amount of this economy in FY2023-24 is around $215 billion (BDT25,240 billion), which is more than three and a half times of the national budget of FY2023-24 and around 84 times of Padma multi-purpose bridge ($3.6bn or BDT301.93bn). So, if the black economic activities can be exposed, then national production will be increased and employment will be created, as well as domestic and foreign borrowing will be decreased. Apart from that direct tax collection rate will be increased and dependency on indirect tax (VAT) will be decreased. It will also reduce the risk of deficit budgets.

According to Bangladesh Bank and various economists, the country’s informal economy is 48% to 84% of total GDP. Considering its average rate of 50%, the amount of this economy in FY2023-24 is around $215 billion (BDT25,240 billion), which is more than three and a half times of the national budget of FY2023-24 and around 84 times of Padma multi-purpose bridge ($3.6bn or BDT301.93bn). So, if the black economic activities can be exposed, then national production will be increased and employment will be created, as well as domestic and foreign borrowing will be decreased. Apart from that direct tax collection rate will be increased and dependency on indirect tax (VAT) will be decreased. It will also reduce the risk of deficit budgets.

- Can Money laundering be stopped?

According to the data of the Bangladesh Economic Association, the total accumulated amount of black money in Bangladesh in last 50 years is more than $1,123 billion (BDT1,32,000 billion), and the amount of smuggled money is more than $101 billion (BDT11,920 billion). If 0.98% of black money and 0.49% of the smuggled money can be recovered from there, then the government can earn $1.25 billion (BDT 150 billion). [Bangla Tribune, 03 June 2024].

As per Global Financial Integrity (GFI) report, every year an average of around $5.5 billion (BDT 640 billion) is siphoned off from Bangladesh to abroad under the guise of international trade. The report also said from 2016 to 2020 (in 5 years) $27.20 billion (BDT3,200 billion) have been smuggled of which $8.30 billion (BDT 980 billion) was in 2015 just in 1 year alone. Bangladesh ranked “Second” in South Asia in terms of amount of money smuggled.

According to Bangladesh Financial Intelligence Unit (BIFU), this money is mainly smuggled abroad through hiding the real value of goods during export-import, bill manipulation, bribery, corruption, tax evasion etc. Even though the government has some policies to prevent money laundering, but could not prevent properly due to lack of proper and effective implementation of the policy. [Shomoy News: 14 May 2022].

According to Customs in Bangladesh, more than BDT 8.21 billion (around USD 85.5 million) are siphoned off from Bangladesh to abroad behind the export of ready-made garments. They said, this is a small part of the whole event, the real scam is much bigger. [BBC News Bangla: 06 September 2023]

At present, dollar crisis is one of the major crises in Bangladesh and Hundi business is highly responsible for this. According to the Criminal Investigation Department (CID) of the police, more than 5,000 agents are conducting Hundi transactions through Mobile Financial Service (MFS) of various mobile phone companies. From 2021 to July 2022, $7.8 billion (BDT 750 billion) was smuggled by hundi traders. To overcome this crisis, exemplary punishment should be given to the high-level criminals instead of petty criminals. [Bangladesh Protidin: 6 September 2023]

D. Tax-VAT burden is rising

The IMF is giving pressure the government to make all VAT rate 15% and it seems they are moving in that direction. VAT was 38% of the total revenue in FY2023-24 which may go up to 50% in the new financial year. VAT always hit badly the lower income group people and it will become more burdensome in the era of high inflation. This indirect tax (VAT) is also responsible for increasing country’s poverty rate. A study conducted by Research and Policy Integration for Development (RAPID) found that if 1% of indirect tax is increased then it increases poverty by 0.42%. The government is not catching those individuals and business entity who are evading billions of dollars of direct taxes rather increasing VAT (indirect tax) rate and its scope as easy tools of revenue mobilization.

The government also is paying more attention to collect and creating scopes of advance income tax to increase tax revenue. As a result, those who pay taxes will fall under pressure. While most of the allowances of govt. employees are exempted from income tax, but for private employees it is not, and it is up to $3,830 (BDT 450 thousand). So, our demand is to increase the lower tax rate and maintain the lower limit of $4,255 (BDT 500 thousand) and to keep previous provisions for tax exemption on allowances and investment. So, we urge the government to abolish such dual standard act or to keep same benefits for private sector employees like government employees in respect of tax payment. There cannot be two laws in the same country. [Prothom-Alo: 05 May 2024]

The government also is paying more attention to collect and creating scopes of advance income tax to increase tax revenue. As a result, those who pay taxes will fall under pressure. While most of the allowances of govt. employees are exempted from income tax, but for private employees it is not, and it is up to $3,830 (BDT 450 thousand). So, our demand is to increase the lower tax rate and maintain the lower limit of $4,255 (BDT 500 thousand) and to keep previous provisions for tax exemption on allowances and investment. So, we urge the government to abolish such dual standard act or to keep same benefits for private sector employees like government employees in respect of tax payment. There cannot be two laws in the same country. [Prothom-Alo: 05 May 2024]

E. Default loans, Banking Instability, and Investment crisis

1. Lack of Good governance in Bank: Irregularities and fraudulences of banks are increasing day by day. According to the data of Bangladesh Bank, in the last 3 months (January-March, 2024), default loans increased by $3.3 billion (BDT 366.62 billion) and at the end of March’24, total defaulted loans stood at $107.5 billion (BDT11,822.95 bn). During 2015, the defaulted loan was around $4.5 billion (BDT 502 billion) and end of March 2024, it has increased almost 4 times/262% than 2015. Among them, in last one year the bad loan of 06 state-owned banks have increased by 42% which is $7.8 billion (BDT 858.69 billion). Out of this amount, $3.2 billion (BDT 350 billion) is to the top 20 defaulters.  Apart from banks, the state-owned organizations have now become defaulters. As per Bangladesh Economic Survey 2024, the amount of defaulted loans of 8 state-owned organizations is $15.6 million (BDT 1.84 billion) and among them, BJMC’s has the highest amounting to $11.2 million (BDT 1.31 billion) which is 71.36%. [Prothom-Alo, 10 June 2024]

Apart from banks, the state-owned organizations have now become defaulters. As per Bangladesh Economic Survey 2024, the amount of defaulted loans of 8 state-owned organizations is $15.6 million (BDT 1.84 billion) and among them, BJMC’s has the highest amounting to $11.2 million (BDT 1.31 billion) which is 71.36%. [Prothom-Alo, 10 June 2024]

According to Center for Policy Dialogue (CPD), in the last 15 years around $8 billion (BDT 922.61 billion) have been looted from public and private banks through different irregularities, which is more than 12% budget of the FY2023-24 and about 2.5 times of total health budget. [BBC News Bangla, 24 Dec’23]

2. Written off of Loans are increasing: Loan written off is made every year to bring back its scenario to a good shape. In this process, banks had written off around $6 billion (BDT 674.40 billion) of defaulted loans in last 20 years (2003 to 2023), thus written off has increased more than 18 times. The consequence is, credit flow is disrupted due to liquidity crisis in banks and as a result small, medium and large-scale industries are suffering for investment. Most of the defaulted loans are not recovered properly as the powerful are behind them, but if the farmers take loans, then they are not given any concession rather in some cases they have to go to jail. [Star Bangla: 06-June 2024; Passenger Voice: 25-June 2024].

3. Bank Integration: Recently the government has taken initiatives to integrate weak banks, of which 10 banks are in the red zone. We think that this integration is giving an opportunity to a particular class of loan defaulters. These banks have turned into weak banks because of unplanned loan disbursements through immense corruption. [Prothom-Alo: 15-April 2024]

F. Has tax evasion been stopped?

End of January 2024, the registered e-TIN (Tax Identification Number) number was 9.97 million, which is 6% of the total population. Among them, 3.67 million taxpayers submitted their annual tax return in FY2023-24 which is 2% of total population and 37% of e-TIN holders which is so low. It is seen, NBR is not paying attention to this rather harassing those who are paying tax regularly and putting them in the trap of law.

Corporate entities and individuals evaded taxes by hiding their real income. Thus, the government is losing revenue around $4.7 billion (BDT 550 billion) to around $25 billion (BDT2,925 billion) annually due to tax evasion and lack of transparency in management. This lost revenue is 8 times budget allocation of Social Safety-Net program; and twice of health budget. If this amount is collected, then per capita expenditure in the health sector could be increased from around $16 (BDT 1,862) to $58 (Tk 6,844) and in the education sector from around $40 (BDT 4,656) to $82 (BDT 9,638). Bangladesh ranks 52nd among 141 countries in terms of tax evasion and tax avoidance. [Bangla News24.com: 3-April’23, Daily Jugantar: 4-April’23]

G. Public Servants Anti-graft laws, rules relaxed

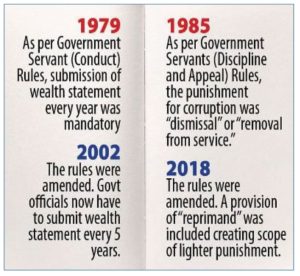

We think that government officials’ corruption has been increased due to the relaxation of anti-graft laws. According to the Government Servant (Conduct) Rules-1979, it was mandatory to submit wealth statement every year by government officials, which was changed in 2002 where wealth statement will be submitted in every 5 years. On the other hand, according to the Government Servant (Discipline and Appeal) Rules-1985, if a government servant commits any corruption, there is a rule of dismissal or loss of job. But in 2018, it has been changed which is either financial penalty or demotion, so no fear of dismissal or loss of job. Mentioned that Mr. Pramatha Ranjan Ghatak while he was Assistant Secretary, embezzled around $0.9 million (BDT 73.50 million) from government land allocation during 2020 to 2021. As a result, he was demoted from the post of Senior Assistant Secretary to Assistant Secretary. We believe that it might break the morality of honest officials or possibility of being dishonest. We recently seen in different medias about corruption of billions of monies by several high officials of police and revenue department. Our concern is that this corruption is also hitting other sectors of the government. This is unfortunate that these billions of monies are people’s tax paid money. [The Daily Star, 29-June 2024]

H. Recommendations:

- Zero-tolerance policy (announced by the Prime Minister) should be implemented to prevent bank robbery, money laundering, corruption, and smuggling.

- The central bank should be independent and strengthened to control the financial sector.

- Special monitoring cells should be formed, and audit reports should be in public so that corporates couldn’t hide their true income.

- Inter-country agreements for information sharing and transparency of bank transactions should be executed with different countries and legal measures should be taken to bring back the laundered money.

- Internal audit should be strengthened, and effective action should be taken against previously found audit objections.

- If a Bangladeshi citizen with dual citizenship has assets and bank accounts in abroad, then he/she must submit bank statements in every year. Strong punishment should be given for hiding information and tax evasion.

- The deficit must be reconciled by reducing government’s various less important expenses without reducing the subsidy under the pressure of foreign donor.

- A ‘Public Expenditure Review Commission’ should be introduced to stop unnecessary expenditure of government in various sectors.

- NBR (National Board of Revenue) should be strong, neutral, transparent and free from influence to prevent direct tax evasion by individuals s and corporates which will reduce dependency on indirect tax especially on VAT.

- To stop buying of anonymous assets and in this regard other country’s law can be followed who are successful.

- (i) Canceling Government Servant (Conduct) Act 2002 and reverting to the 1979 Act, and (ii) Canceling Government Servant (Discipline and Appeal) Act 2018 and reverting to the 1985 Act. Where it was mandatory to submit wealth statement by the government officials every year and provision of dismissal or separation from service if corruption is proved.

Download the position paper [English] [Bangla]

By: Md. Ahsanul Karim, COAST Foundation/EquityBD, Dt: 29-June 2024